“It is not the manager’s job to prevent risks. It is the manager’s job to make it safe to take them.“

Edwin Catmull, Scientist

Pros and Cons of Working as a Risk Manager

You think about becoming a risk manager and want to know more about this job before making your final career choice? Great!

This article is exactly for you since I will show you all the pros and cons of being a risk manager in the following chapters.

Table of Contents

Risk Manager Job Profile

| Job Description | Risk managers are responsible for managing several business and market risks to assure the long-term survival of the company they work for. |

| Salary | $105,000 per year on average, most risk managers make between $85,000 and $125,000 per year. |

| Job Security | Decent since good risk managers are high in demand right now. |

| Job Satisfaction | Decent if you love to work with numbers. |

| Work-Life Balance | Decent since you will have free weekends and also don’t work many extra hours. |

| Physically / Mentally Demanding? | Being a risk manager can be mentally demanding. |

| Future Outlook | Decent since good risk managers will always be needed. |

| Requirements | You need a college degree for becoming a risk manager in most regions. You may also need some additional certificates to work in this field. |

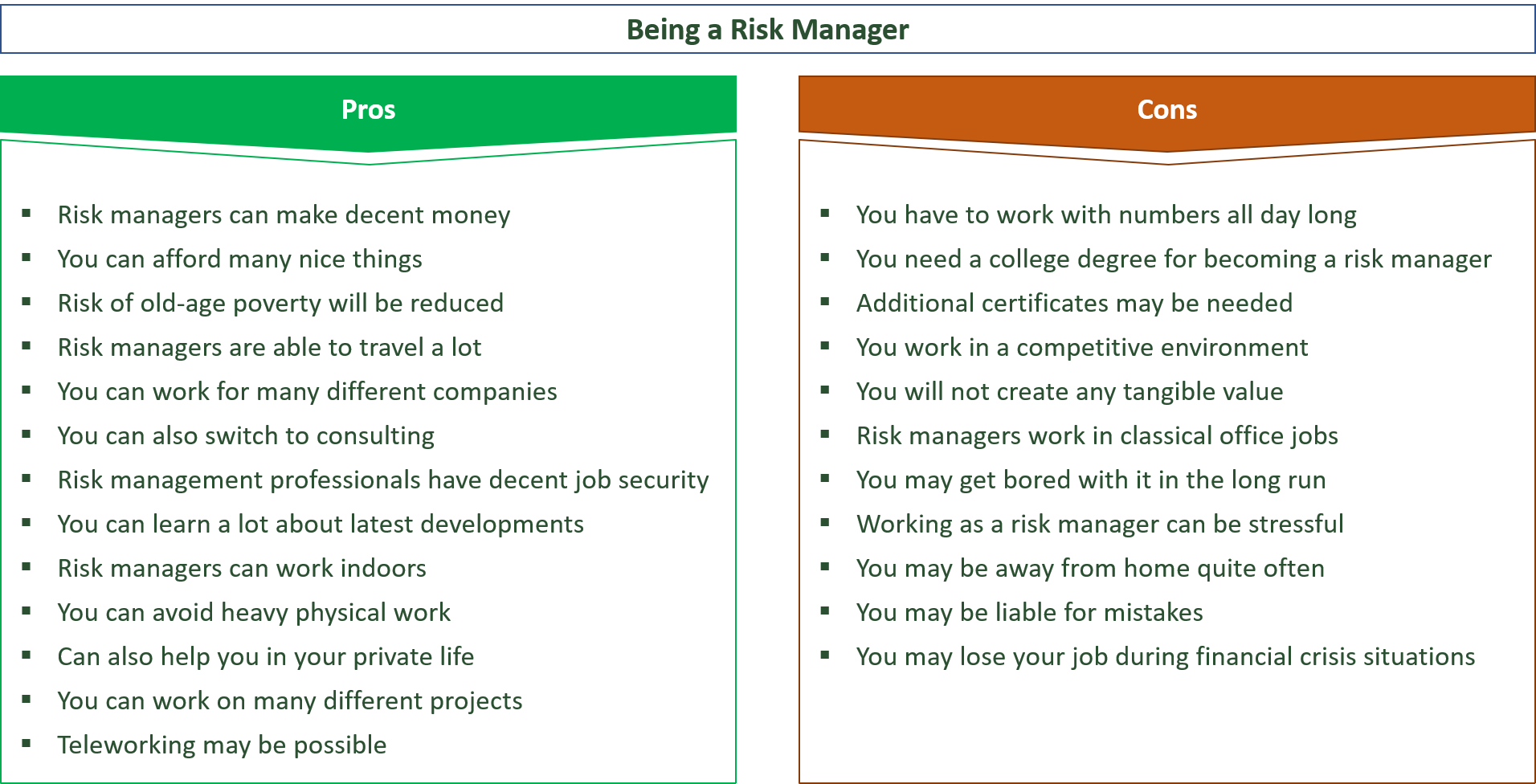

Advantages of Being a Risk Manager

- Risk managers can make decent money

- You can afford many nice things

- Risk of old-age poverty will be reduced

- Risk managers are able to travel a lot

- You can work for many different companies

- You can also switch to consulting

- Risk management professionals have decent job security

- You can learn a lot about latest developments

- Risk managers can work indoors

- You can avoid heavy physical work

- Can also help you in your private life

- You can work on many different projects

- Teleworking may be possible

- Good future job prospects

- You can work with ambitious people

- You can work with many different departments

- You can build a strong network as a risk manager

- Risk managers don’t have to work on weekends

- Decent work-life balance for risk management specialists

Risk managers can make decent money

One advantage of being a risk manager is that you can make really good money from what you are doing.

In fact, many risk managers are able to make a six-figure income sooner or later and this is more money than tilers and most other people will make.

If you are really ambitious, you may even get into leading roles of the company you work for and you may be able to double or triple your starting salary due to that.

Consequently, there is a lot of financial opportunity in the risk management business and if money is really important to you, becoming a risk management specialist can definitely make quite a lot of sense in this regard.

You can afford many nice things

Due to your decent salary, you will also be able to afford some luxury as a risk manager.

Not only will you be able to afford a nice car and fancy clothes, but you will also be able to afford a nice home sooner or later.

Also your chances to get a mortgage for the home you want to buy will be pretty good since banks will trust your financial judgement.

Hence, while many other people will struggle to afford those nice things and getting a mortgage to buy a home, you will have a rather easy time in this regard and can really fulfill your childhood dreams.

Risk of old-age poverty will be reduced

You will also not have to suffer from old-age poverty if you invest part of your monthly salary wisely.

Thanks to your decent salary, you can save a substantial amount of money that you can invest in the stock market or in other financial instruments that can deliver you decent returns.

If you do so for many years, chances are that you will have saved a good chunk of money which you can use for retirement age to pay your bills.

Risk managers are able to travel a lot

As a risk manager, you will also have the opportunity to travel a lot.

You will always have to supervise the processes inside your company and especially in big corporations, that means traveling a lot and seeing what’s going on in various different departments and buildings in person.

Hence, by becoming a risk manager, you will also be able to travel the world for free while still getting paid decent money, at least if you work for big international corporations that have branches and subsidiaries all around the world.

You can work for many different companies

Another upside to becoming a risk manager is that you can work for many different companies.

In fact, almost every company of a certain size needs risk managers to supervise how the company is doing and to assess potential risks properly to avoid any unpleasant surprises in the near future.

Consequently, you as a risk manager will often have the freedom of choice regarding where you want to work and can choose the company that provides the best working conditions to you.

You can also switch to consulting

Becoming a risk management specialist doesn’t mean to only work in the industrial or banking sector.

You could also start your career as a risk manager in those companies and then switch to the consulting sector.

You could also just start your career as a risk manager in a consulting firm right from the beginning.

Hence, a career in risk management also gives you lots of flexibility in terms of in which field you want to work. If you are an outgoing and extroverted person, you may want to go for a risk management consulting career.

If you are a rather introverted person, you may want to work in the back office of a company in the industrial sector instead.

Risk management professionals have decent job security

Another benefit of being a risk management professional is that you will also enjoy pretty decent job security.

In fact, good risk managers are in high demand right now while there is a shortage of really good people in this field at the same time.

This means that you will get many job offers if you have good education in this field and you will also be able to negotiate really good terms.

You will also not have to worry about losing your job that much.

Even if this happens, you will still have many other options and chances are that you will find another company that is willing to employ you pretty soon.

You can learn a lot about latest developments

Risk managers always have to learn about the latest developments and about technological progress in general.

Otherwise, they are not able to give proper advice to the senior management of their company and the company will likely be hit by a financial shock sooner or later.

While it can be exhausting and demanding to always stay ahead of the game, it still gives you the opportunity to learn a lot during your career as a risk management professional and the more you learn, the more valuable skills you will accumulate which will make you also much more valuable to many other companies.

Risk managers can work indoors

Another advantage of being a risk management professional is that you will also be able to work indoors in a nice cozy office while many other people will not have this luxury.

In fact, many people out there still have to work under extreme conditions and will also have to work outdoors during extreme heat or cold.

Thus, while you will be able to enjoy a nice coffee and can use air conditioning and cooling at work, many other people will not be able to enjoy those nice working conditions and will secretly wish to change places with you.

You can avoid heavy physical work

As a risk manager, you will also be able to avoid heavy physical work.

Of course, this doesn’t mean that your work will not be demanding.

However, it will be demanding from a mental, not from a physical perspective.

Consequently, while many people out there have to lift heavy things all day long and ruin their spine in the long run, you can avoid those issues as a risk management professional since you will sit in a comfortable office chair all day long.

Can also help you in your private life

The more knowledge you accumulate when it comes to managing risk, the better your decisions will be in this regard.

Risk management skills are not only crucial for your professional life, but they are also pretty valuable when it comes to various other decisions for your private life.

For instance, if you buy a home, you have to make sure that you are actually able to afford it.

The same is true for buying a new car and for other expenses that can bring you in financial trouble.

As a risk manager, you will often have an eye for financial issues that may come along with those expenses and you will be much better able to make good decisions in this regard compared to the average person who barely knows anything about managing risk at all.

You can work on many different projects

Risk management is not a rigid process.

Over time, circumstances will change and risk changes as well.

Due to our technological progress, companies have to deal with many risks that had been non-existent in the past decades.

This includes cyber risk and other risks related to our rapid technological development.

To be able to deal with those new forms of risk, you will have to work with many different people and also have to work on many different projects over time.

In turn, you will also learn how your company really works and this can be an extremely valuable tool, especially if you want to get into a leading role in your company sooner or later.

Teleworking may be possible

If you work for a big company, chances are that you will also be able to work remotely as a risk manager, at least for some days of the week.

In fact, you will be able to do almost all of your work from home and don’t have to commute to the office for it.

You can also use video calls to interact with your colleagues.

In turn, you will be able to save lots of time on commuting and you will also be able to do many small things for your private life while you are officially working at the same time.

For instance, between two meetings, you can start your washing machine or other things that have to be done.

Consequently, you will also have less private work left after you finish your workday and this means that you will also be able to enjoy more leisure after work.

Good future job prospects

Good risk managers will also be needed in the future. Risk always evolves and there may be risks in the future that nobody has ever heard of right now.

Consequently, the demand for risk management professionals will likely also be high in the future and you will therefore not have to fear becoming unemployed if you go for this career path.

You can work with ambitious people

I personally worked as a risk manager and can therefore tell you that you will also be able to meet many ambitious people along the way.

Some of those people have really extraordinary skills and working in such an environment also motivates you to develop your own skills even further to become better than the competition.

In turn, you will also learn a lot and will become even more valuable in the job market.

You can work with many different departments

Risk management is also a thing that affects various different departments.

In fact, risk managers have to look at the interconnections between different subsidiaries, branches and departments of companies to figure out what risks are inherent and how to hedge those risks.

Consequently, you will also be able to talk to many different people in many different departments and this makes your job quite interesting since you will get to know the company you work for much better than most other employees.

You can build a strong network as a risk manager

Since you will talk to many different people, you will also be able to build a really strong business network as a risk manager.

Many of those people whom you will meet along the ride will quit their jobs in the company you work for and work for different companies later in their lives.

Thus, you will also have many contacts to different companies and if you want to work for one of those companies in the future, you will have a pretty easy time since you already have a person inside this company who knows and trusts you.

Risk managers don’t have to work on weekends

You will also not have to work on weekends as a risk manager.

Quite often, you will just work rather regular workweeks and this means that you will often be able to meet up with people after work or to spend some quality time with your family.

Decent work-life balance for risk management specialists

In general, most risk management professionals also report that they enjoy a pretty decent work-life balance.

In fact, most of them are satisfied with the level of leisure they have and some of them would even be willing to work more.

Hence, becoming a risk manager can also make sense for you in case your leisure is really important to you while you still want to make good money from your job at the same time.

Now that we have talked about all the chances that come along with working as a risk management professional, we also have to take a look at all the downsides related to this career path.

Disadvantages of Working as a Risk Management Specialist

- You have to work with numbers all day long

- You need a college degree for becoming a risk manager

- Additional certificates may be needed

- You work in a competitive environment

- You will not create any tangible value

- Risk managers work in classical office jobs

- You may get bored with it in the long run

- Working as a risk manager can be stressful

- You may be away from home quite often

- You may be liable for mistakes

- You may lose your job during financial crisis situations

You have to work with numbers all day long

One problem with being a risk manager is that you will have to work with numbers all day long.

While this can be nice for people who really have an analytical mindset and strong mathematical skills, it can really be a struggle for people who don’t have a natural talent for those things.

Consequently, make sure that you have some talent in this regard before becoming a risk manager since you will just not get happy with what you are doing otherwise.

You need a college degree for becoming a risk manager

You will also need long years of education for becoming a risk manager.

Quite often, you will need a college degree for working in this field.

While most people hold a bachelor’s or master’s degree, some risk managers even have a doctor’s degree in mathematics or physics.

As you can see, the educational requirements to work in this field can be pretty high and this means that you will have to spend many years on college education while many of your friends who work as garbage collectors and many other fields where you don’t need a degree can make money much sooner in their lives.

In turn, you will also have to spend lots of money on tuition and other expenses related to college and you should therefore make sure that you are willing to make this commitment for your career before you decide for becoming a risk manager.

Additional certificates may be needed

Some companies not only require a college degree, but they also require further degrees.

For instance, many risk managers get certifications as financial risk managers (FRM) or similar certifications that are common in this field.

Consequently, don’t expect that your educational path will be over after college.

As a risk manager, you will always have to develop your skills further and there will never be a time to rest if you want to get and stay really good at what you are doing.

You work in a competitive environment

Since many people want to work in the risk management industry, you will also enter a quite competitive field.

While it can be interesting to work with really good people, this also means that you will have to compete with those people and if you don’t have the mental capacities to do so, this can be really frustrating and your chances for promotions may also be rather low.

Hence, you should take an honest look into the mirror and ask yourself if you are really good enough to compete in this industry before becoming a risk manager and learn it the hard way.

You will not create any tangible value

Another downside to working as a risk manager is that you will often not create any tangible value.

Instead, you will analyze the risk exposure of your company through complex models and those models often only provide you with a few key numbers.

Therefore, you will often work for a long time just to get those numbers while other people who work in the production sector will really see what they have achieved when they finally look at the end product.

Risk managers work in classical office jobs

You should also ask yourself whether you are the type of person who wants to work in classical office jobs or if you rather want to work outside of those artificial environments and want to do more hands-on work instead.

If you are not the office type of person, chances are that you will not become happy with what you are doing and you should rather go for a different career path instead.

You may get bored with it in the long run

While working in risk management may be exciting at first, it can also become pretty boring in the long run.

Hence, make sure that managing risk is really your passion and that you don’t get into this field just for the money to stay content and motivated in the long run.

Working as a risk manager can be stressful

Another disadvantage of becoming a risk manager is that you will also be exposed to plenty of stress.

Quite often, risk managers have to handle demanding situations and in case your company gets into financial distress, you will often be the one who will be made responsible for it, even though it might not have been your fault.

You may be away from home quite often

As a risk manager, you will also have to travel a lot.

While some people really love traveling and seeing the world, others rather want to stay at home with their family and if you belong to the second group of people, chances are that you should rather go for a different career choice instead of becoming a risk management professional.

You may be liable for mistakes

If you reach a certain level and get into a leading role in your company, you may even become personally liable for mistakes that could potentially ruin your private financial situation.

Consequently, make sure to get proper insurance to be covered in such a case.

You may lose your job during financial crisis situations

Many risk managers also get fired in financial crisis situations and it will often not be easy to find a new job during those adverse market conditions.

Top 10 Being a Risk Manager Pros & Cons – Summary List

| Being a Risk Manager Pros | Being a Risk Manager Cons |

|---|---|

| Risk managers can make good money | Risk management can be stressful |

| You don’t work many extra hours | You may be liable for mistakes |

| Free weekends and holidays | You may become the scapegoat |

| Risk managers are high in demand | Risk managers are away from home often |

| Good future job prospects | Competitive work environment |

| You can work for many companies | Risk managers need a college degree |

| Can also help you for your private life | You may need additional certificates |

| You will be able to invest your money wisely | You work in a classical office job |

| Risk of old-age poverty can be reduced | You may get bored sooner or later |

| You can avoid physical work | You will not achieve tangible results |

Should You Become A Risk Manager?

Now that you know all the advantages and disadvantages of being a risk manager, you should take your time and evaluate all the pros and cons carefully to make the best possible decision regarding your future career path.

You still want to become a risk manager? Make sure to also get detailed information on the salary, career prospects, future outlook, educational requirements, duties, work-life balance and job satisfaction of risk managers.

Also make sure to check out the following articles:

Advantages and disadvantages of becoming an investment banker

Advantages and disadvantages of becoming a financial analyst

Advantages and disadvantages of becoming a pastor

Sources

https://en.wikipedia.org/wiki/Risk_management

https://www.statista.com/statistics/476107/trm-applications-market-worldwide/

About the author

My name is Andreas and my mission is to educate people about the different career paths that are possible in our current state of the world. In my opinion, people often make the mistake to choose their profession solely based on how much money they can earn from it instead of doing what makes them really happy.

This is quite sad and I just want to give people a more objective picture of how a fulfilling career could look like. I did the same when I started working in consulting after finishing my Master’s degree in Economics. However, I’ve quit pretty soon after that since I haven’t found true meaning in my job.

Now I can do what I really love to do and I want to enable as many other people as well to go this exciting path towards happiness instead of money.

I conducted various interviews with employees to give you a good impression of what working in different fields will look like and that you can make the best possible decision regarding your future career choice.

Wanna support my blog? Share it!