Pros and Cons of Working as an Insurance Agent

You think about becoming an insurance agent but are not sure whether this profession is the right way to go for you? Great!

Stick with me since I will show you all the pros and cons of being an insurance agent so that you can better decide whether you still want to work in this field or if you want to go for other career options instead.

Table of Contents

Insurance Agent Job Profile

| Job Description | Insurance agents consult and sell insurance products to their clients and make sure that they are covered in case of emergency. |

| Salary | $63,000 per year on average, most insurance agents make between $48,000 and $83,000 per year. |

| Job Security | Decent since good insurance agents are needed right now. |

| Job Satisfaction | Rather poor since you may have to sell products you don’t believe in. |

| Work-Life Balance | Decent since you will enjoy free weekends and holidays and will not have to work many extra hours. |

| Physically / Mentally Demanding? | Can be mentally demanding. |

| Future Outlook | Rather poor since many people will no longer rely on the advice of insurance agents in the future but rather use our modern technology to make decisions in this regard. |

| Requirements | While some insurance companies require a college degree, others only require a high school diploma. |

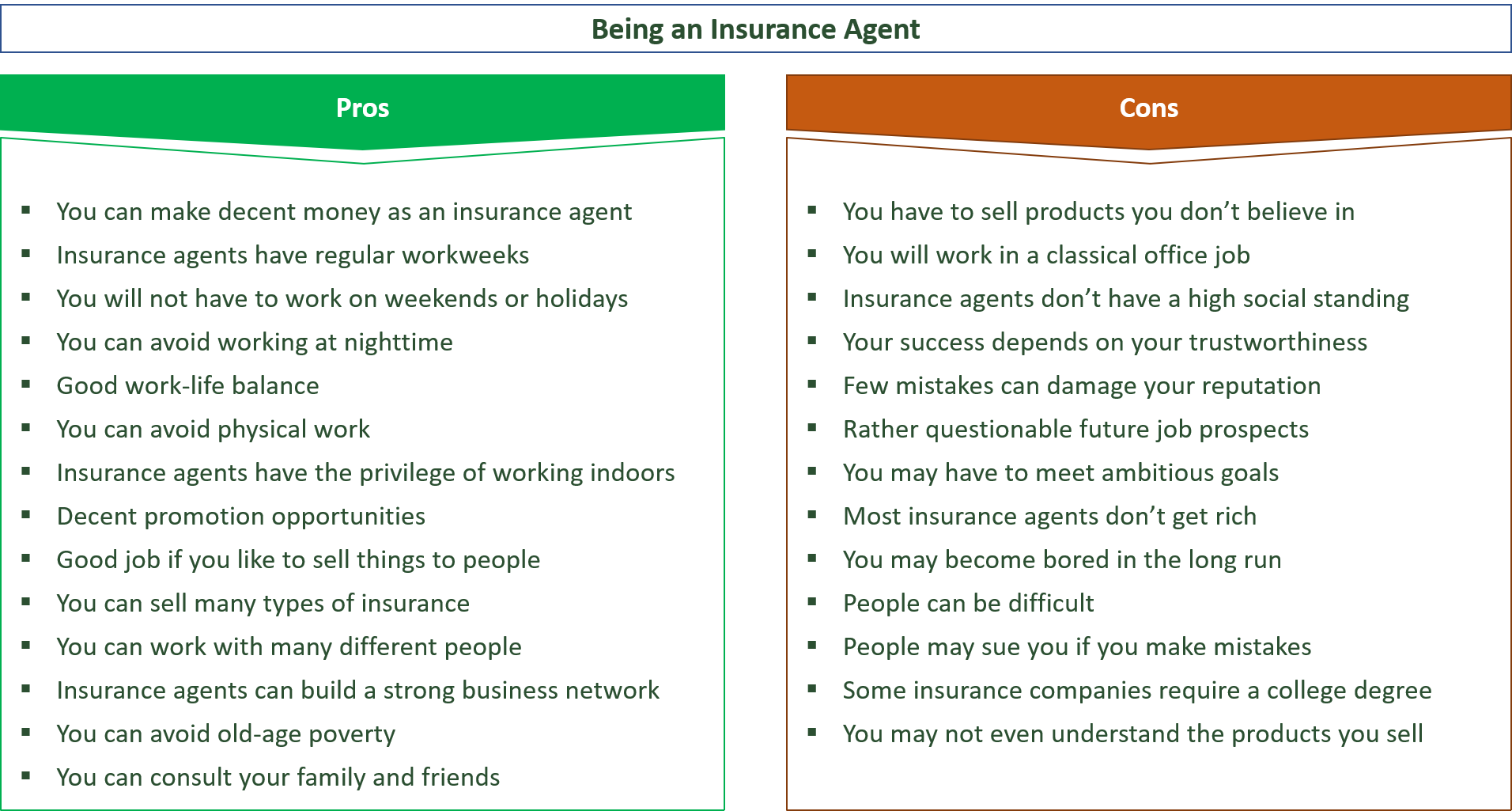

Advantages of Being an Insurance Agent

- You can make decent money as an insurance agent

- Insurance agents have regular workweeks

- You will not have to work on weekends or holidays

- You can avoid working at nighttime

- Good work-life balance

- You can avoid physical work

- Insurance agents have the privilege of working indoors

- You can help people make better decisions regarding insurance

- Decent promotion opportunities

- Good job if you like to sell things to people

- You can sell many types of insurance

- You can work with many different people

- Insurance agents can build a strong business network

- You can avoid old-age poverty

- You can consult your family and friends

- Teleworking may be possible

- Becoming an insurance agent can also help you in your private life

You can make decent money as an insurance agent

One advantage of working as an insurance agent is that you can make pretty good money if you know what you are doing and if you are willing to work hard.

Sure, not all insurance agents will make decent money and some of them may even struggle to pay their bills.

However, if you have good people skills and your clients will trust you blindly, you will have good chances to succeed as an insurance agent and can make much more than people working in a fast food restaurant and many other people out there.

You may even be able to afford some luxury and some insurance agents even make a six-figure income.

Hence, if money is really important to you, a career in insurance can be one way to go.

Insurance agents have regular workweeks

As an insurance agent, you will also be able to enjoy regular workweeks if you work for major insurance companies out there.

In fact, most insurance agents will start working between 7 and 9 a.m. and will leave their workplace between 5 and 6 p.m.

Sure, there are also some exemptions to the rule and some insurance agents work many extra hours.

Yet, the majority of insurance agents will have a rather relaxed life and becoming an insurance agent will therefore also be great for you in case leisure is pretty important to you.

You will not have to work on weekends or holidays

Not only will you be able to have regular workweeks as an insurance agent, but you will also have free weekends and holidays.

While you might take this for granted, it is actually a luxury since many other people have to work during those times.

For instance, trains cannot just stop operating just because it is Saturday or Sunday.

They have to operate every day so that people who don’t have a car can get from A to B.

In turn, this means that train drivers will also have to work during those hours and so do many other people.

In contrast, as an insurance agent, you will be able to enjoy your leisure during those times while other people have to work and this gives you additional opportunities to spend quality time with your family and also to make nice weekend trips with your favorite people.

You can avoid working at nighttime

Another advantage of being an insurance agent is that you also don’t have to work at nighttime.

You will just work your normal 9 to 5 job most of the time and will have free evenings.

This means that you can meet up with your friends or spend your leisure on your hobbies.

Many other people don’t have this luxury and will have to work during the evenings.

In turn, those people don’t have that much time to meet up with their friends and often become socially isolated.

Moreover, sleeping problems are quite common for people who have to work late at night.

In turn, those people often suffer from serious health issues since good sleep is crucial for our body and our brain to stay healthy in the long run.

As an insurance agent, you can avoid all those issues and this can greatly improve your overall quality of life.

Good work-life balance

Since you will have free weekends, holidays and also work standard workweeks without having to work many extra hours, most insurance agents also report a pretty good work-life balance in general.

In fact, if you are able to get a job at one of the big insurance companies, chances are that you will be able to enjoy plenty of leisure while still making decent money at the same time.

Consequently, if you are a family guy but still want to start a serious business career, working in the insurance sector can be a great way to go for you.

You can avoid physical work

Another benefit of a career as an insurance agent is that you can also avoid physical work.

While working as an insurance agent can be mentally demanding and you may have to handle many clients in a rather short period of time, you can still avoid the heavy physical work many people in other jobs have to do.

For instance, a construction worker has to lift heavy stuff all day long and this can be quite exhausting.

Moreover, lifting those heavy things on a regular basis can also greatly hurt your back and may lead to serious physical health issues in the long run.

You as an insurance agent can avoid those issues since you will rather work with your brain than with your bare hands and this means that your risk of suffering from physical health problems will be significantly lower in the long run.

Insurance agents have the privilege of working indoors

Another upside to becoming an insurance agent is that you will also be able to work indoors.

While you may take this for granted, there are still many people out there who are not able to enjoy the luxury of working indoors.

Instead, they have to work outdoors even during periods of rain and snow and this can be quite annoying.

As an insurance agent, you can rather work in a cozy office where you will even have air conditioning or heating to make your time at work as convenient as possible.

You can help people make better decisions regarding insurance

As an insurance agent, you will also be able to sell people insurance policies that can protect those people from serious issues.

In fact, good insurance products are crucial so that people are covered in case of emergency.

Sure, not all insurance products make sense and whether one kind of insurance is suitable for you also depends on your individual circumstances.

Nevertheless, if you listen to your clients and figure out what phase of their lives they are currently in, you can give them proper advice on what insurance products make sense.

In turn, your clients will be much better able to plan for their future since you have removed significant insecurity from their lives.

Decent promotion opportunities

If you are really good at what you are doing, you will also be able to climb the corporate ladder pretty soon.

In fact, good insurance agents will have many different promotion opportunities and you may also get into a leading role in your company rather soon.

Thus, you will also not be stuck in your job forever when you first start as normal insurance agent.

Chances are that you will get much more responsibility soon and this will often also translate into a higher salary.

Good job if you like to sell things to people

Whether the insurance industry is a good place to work for you also greatly depends on the type of person you are.

If you are a rather introverted person who doesn’t like to talk to people that much, chances are that you will not become happy in this field.

However, if you are a rather extroverted personality with strong selling skills, chances are that you will find your dream job as an insurance agent since you can combine your passion for selling with your outgoing character and this combination will often lead to significant success in this field.

You can sell many types of insurance

As an insurance agent, you will also be able to work for many different insurance companies and can also sell many different products.

In fact, there are hundreds if not thousands of insurance products you can sell in many different niches like car insurance, health insurance, life insurance and so on.

Opportunities are almost endless in this regard and this means that you will be free to specialize in the field you are interested in most.

In turn, you can become a real expert in your field and will have an easy time convincing people that you will be able to find the best insurance products for them.

You can work with many different people

Another benefit of working as an insurance agent is that you will also be able to work with many different clients.

In fact, you will consult many different people each day and this means that you will get in touch with many different characters.

Not only can this be quite interesting, but it also gives you the opportunity to really develop your people skills and to get to know how the human psyche really works.

If you learn what drives people, you will have a much easier time, not only at work but also on various other occasions in your life.

Insurance agents can build a strong business network

You will also be able to build a strong network as an insurance agent.

Quite often, you will sell insurance products to influential people who are in leading positions in their companies.

In turn, if you have contact with those people, you may be able to switch fields in case you are no longer interested in working as an insurance agent.

In fact, you will have a huge advantage in the job market if you have good contacts to people who work in many different companies since they can tell you when positions are going to be vacated and you can therefore apply before other people do and will have much better chances to get the job.

You can avoid old-age poverty

Since you will be able to make decent money as an insurance agent, you will also be able to save and invest some money and this may protect you from old-age poverty and the related unpleasant consequences.

In our current state of the world, many people don’t have this luxury since they just work in low-wage jobs and are not able to save enough money for retirement age.

In turn, those people will often not be able to pay their bills once they retire and may even end up homeless since they may no longer be able to pay their rent.

As an insurance agent, you can avoid those issues, at least if you are financially responsible and don’t waste your money on things you actually don’t need instead of investing it in senseful investment projects.

You can consult your family and friends

When it comes to insurance, many people out there also don’t have any idea what’s important and what they have to pay attention to.

In fact, chances are that also your family and friends will be pretty helpless in this regard.

In such a case, you as an insurance agent can greatly help them out and explain what insurance will be most beneficial for them so that they can avoid getting into trouble sooner or later.

Teleworking may be possible

As an insurance agent, you may also be able to work from home.

Especially on days where you will not have client meetings, there will often not be the need to commute to the office.

Instead, you can work from home in a rather quiet and cozy atmosphere and this also gives you more flexibility to do your private work.

Becoming an insurance agent can also help you in your private life

Extensive knowledge about different insurance products can also greatly benefit you in your own personal life.

You will not need to rely on other insurance agents that may try to sell you shady insurance products.

Instead, you can use your own common sense and your knowledge from your job to make the right decisions in this regard.

As you can see, there are definitely many advantages of becoming an insurance agent.

Yet, you should not expect that working in this field is all upside.

There are still some issues with a career in the insurance sector which I want to show you in the following chapter.

Disadvantages of Working as an Insurance Agent

- You have to sell products you don’t believe in

- You will work in a classical office job

- Insurance agents don’t have a high social standing

- Your success as an insurance agent depends on your trustworthiness

- Few mistakes can damage your reputation

- Rather questionable future job prospects for insurance agents

- You may have to meet ambitious goals

- Most insurance agents don’t get rich

- Working as an insurance agent may become boring in the long run

- People can be difficult

- People may sue you if you make mistakes

- Some insurance companies require you to get a college degree

- You may not even understand the products you sell

You have to sell products you don’t believe in

One problem with being an insurance agent is that you will often have to sell insurance products you actually don’t believe in.

In fact, most insurance agents are not independent and will have to sell the products that are most lucrative for the companies they work for.

In turn, you may not be happy with your work at all since you know that you consult people in a misleading way instead of offering the products that would really fit best for their individual circumstances.

You will work in a classical office job

As an insurance agent, you will also have to work in a classical office job.

Most of the time, you will just sit in front of your computer and stare at the screen or answer calls you might get.

Sure, from time to time, you will also have client meetings.

Yet, you will still spend most of your workday in a rather artificial office environment while foresters and many other people are able to work in a more interactive manner outdoors.

Insurance agents don’t have a high social standing

Many people also mistrust insurance agents since they have made bad experiences with them in the past.

Consequently, insurance agents don’t have a high social standing and you may also get many snarky comments when you tell people about your profession.

Your success as an insurance agent depends on your trustworthiness

As an insurance agent, your level of success will also significantly depend on your trustworthiness.

If people don’t trust you, they will simply not buy insurance products from you.

This can be problematic, especially if you just don’t look trustworthy at all and are just not born with a sympathetic aura.

Few mistakes can damage your reputation

Another downside of working as an insurance agent is that only few mistakes can damage your reputation and ruin your career.

People talk to each other on a regular basis and if someone tells his or her friends about your mistakes, those people will be less eager to buy insurance products from you.

Consequently, if the message spreads that you sell dodgy insurance policies, you may no longer be able to work in this field and may have to go for another career path instead, even though your intention might have been good.

Rather questionable future job prospects for insurance agents

In our current state of the world, the job market changes rather quickly and it is also questionable whether insurance agents will still be needed in the future.

In fact, an increasing number of people use the internet to inform themselves about insurance and do no longer want to rely on insurance agents.

If this trend continues, you may suffer from pretty poor job prospects and may become unemployed soon.

You may have to meet ambitious goals

Insurance companies may also set pretty ambitious goals for you which you have to meet.

For instance, your boss may tell you that you have to sell a number x of insurance products.

If you don’t meet this number, chances are that you will get fired pretty soon.

Hence, the mental pressure can be enormous for insurance agents and you should not underestimate the stress that comes along with it.

Most insurance agents don’t get rich

Even though you may be able to make a decent living from what you are doing, you will still not get rich as an insurance agent.

Thus, if you want to make really good money, you should become a doctor or lawyer instead.

Working as an insurance agent may become boring in the long run

While you might be excited to work as an insurance agent in the beginning, this initial excitement may vanish rather quickly.

In the long run, you may become pretty bored with what you are doing and many insurance agents secretly wish to work in a different field instead.

People can be difficult

Another disadvantage of becoming an insurance agent is that you will also have to deal with many difficult people.

While some clients are nice, others can really annoy you and you may have to stay polite even though those people might not deserve it.

People may sue you if you make mistakes

If you make mistakes, you may even get sued in the worst case.

Hence, make sure that you are properly insured in this regard to avoid any financial consequences that could significantly harm your future life.

Some insurance companies require you to get a college degree

While some insurance companies don’t require a college degree, others want you to have at least a bachelor’s degree.

Especially big insurance companies are more eager to employ people who hold a degree and if you want to maximize your chances to get a job in this field, you may have to spend many years in college and also have to spend lots of money on tuition and other expenses related to college education.

You may not even understand the products you sell

Some insurance products are also such complicated that you may not even understand the mechanics behind them.

In such a case, you may have to sell products you don’t fully understand to your clients and you may therefore suffer from a pretty bad conscience in the long run.

Top 10 Being an Insurance Agent Pros & Cons – Summary List

| Being an Insurance Agent Pros | Being an Insurance Agent Cons |

|---|---|

| Insurance agents can work indoors | Insurance agents have to sell things |

| Decent work-life balance | You may not believe in your own products |

| You will not work many extra hours | Insurance agents have a low social status |

| Free weekends and holidays | Clients can be difficult |

| Insurance agents can help their loved ones | Clients may even sue you |

| Can be beneficial for your private life | You may become bored in the long run |

| Insurance agents can make decent money | You will not get rich as an insurance agent |

| Good promotion opportunities | Few mistakes can ruin your reputation |

| Insurance agents can avoid physical work | Some companies require a college degree |

| You can work from home | Rather poor future job prospects |

Should You Become An Insurance Agent?

As you can see from the previous discussion, there are many advantages and disadvantages to working as an insurance agent.

In the end, you should carefully evaluate all the pros and cons of working in the insurance sector so that you can make a profound decision regarding this important topic.

If you still want to become an insurance agent, you should also get detailed information on the salary, future outlook, duties, job satisfaction, working hours, work-life balance and educational requirements of insurance agents.

Also make sure to check out the following articles:

Advantages and disadvantages of working as a politician

Advantages and disadvantages of working as an air traffic controller

Advantages and disadvantages of working as a painter

Sources

https://www.statista.com/statistics/194232/number-of-us-insurance-brokers-and-service-employees/

https://en.wikipedia.org/wiki/Independent_insurance_agent

About the author

My name is Andreas and my mission is to educate people about the different career paths that are possible in our current state of the world. In my opinion, people often make the mistake to choose their profession solely based on how much money they can earn from it instead of doing what makes them really happy.

This is quite sad and I just want to give people a more objective picture of how a fulfilling career could look like. I did the same when I started working in consulting after finishing my Master’s degree in Economics. However, I’ve quit pretty soon after that since I haven’t found true meaning in my job.

Now I can do what I really love to do and I want to enable as many other people as well to go this exciting path towards happiness instead of money.

I conducted various interviews with employees to give you a good impression of what working in different fields will look like and that you can make the best possible decision regarding your future career choice.

Wanna support my blog? Share it!