Pros and Cons of Working as a Loan Officer

You think about becoming a loan officer but want to get additional information about work-life balance, salaries, job prospects, educational requirements, promotion opportunities and much more before making your final decision in this regard?

Great! This article is exactly for you since I will show you the pros and cons of being a loan officer in the following chapters.

Table of Contents

Loan Officer Job Profile

| Job Description | Loan officers check, evaluate, recommend and approve loan applications for private loans, mortgages, etc. Loan officers often work for big banks, credit unions and mortgage companies. |

| Salary | $67,000 per year on average, most loan officers make between $46,000 and $79,000 per year. |

| Job Security | Loan officers have decent job security since an increasing number of people need loans to finance big projects and you can also work for many different companies. |

| Job Satisfaction | Good if you love to work in an office environment and also want to work with new clients on a regular basis. |

| Work-Life Balance | Loan officers have pretty decent work-life balance since they often don’t have to work on weekends and also come home from work relatively early. |

| Physically / Mentally Demanding? | Working as a loan officer can be mentally demanding. |

| Future Outlook | Questionable future outlook for loan officers since many jobs in this industry will be lost to intelligent machines in the near future. |

| Requirements | While some loan officers are employed with just a high school diploma, most loan officers hold at least a bachelor’s degree in business, economics, finance or a related field. |

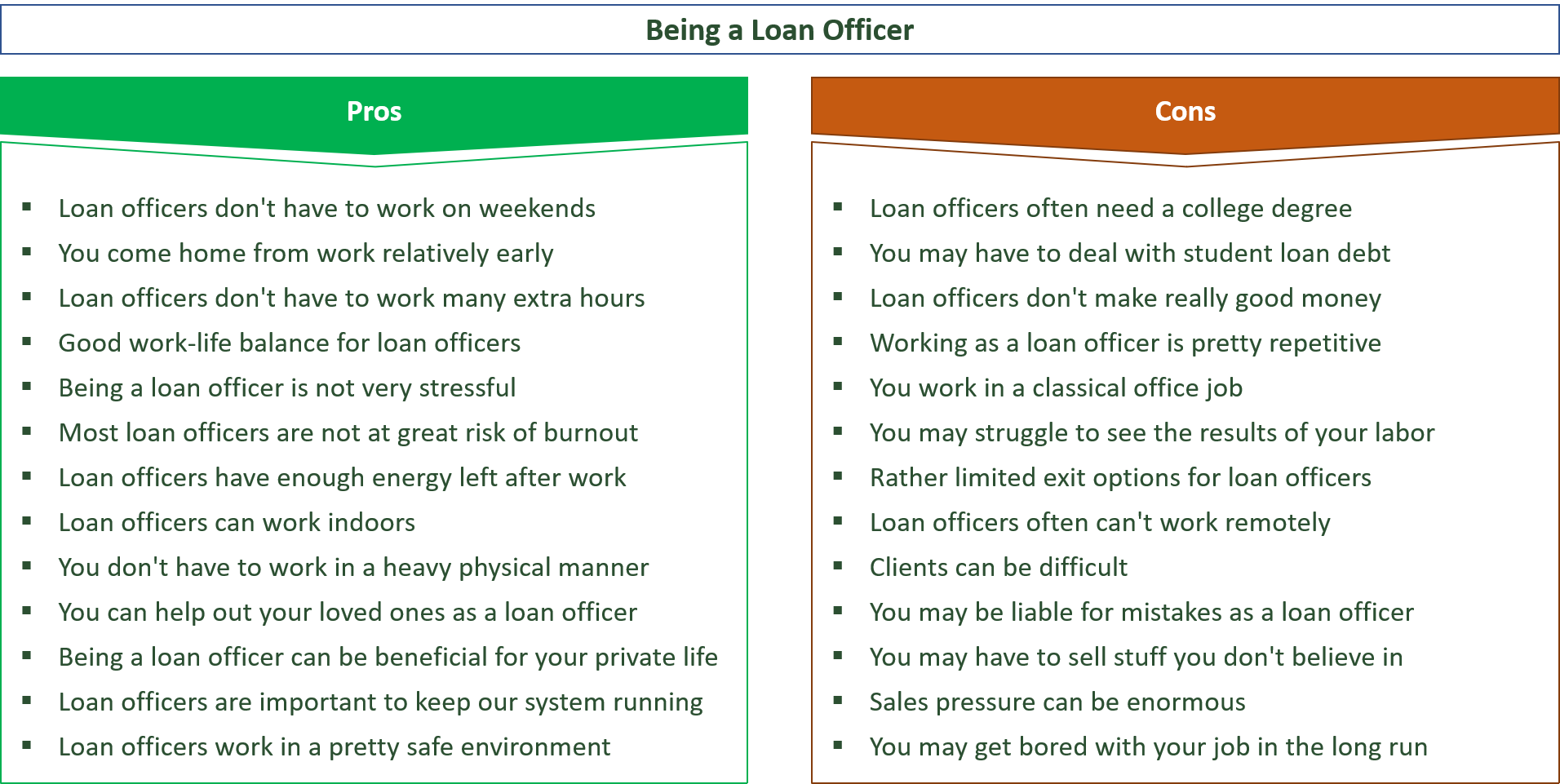

Advantages of Being a Loan Officer

- Loan officers don’t have to work on weekends

- You come home from work relatively early

- Loan officers don’t have to work many extra hours

- Good work-life balance for loan officers

- Being a loan officer is not very stressful

- Most loan officers are not at great risk of burnout

- Loan officers have enough energy left after work

- Loan officers can work indoors

- You don’t have to work in a heavy physical manner

- You can help out your loved ones as a loan officer

- Being a loan officer can be beneficial for your private life

- Loan officers are important to keep our system running

- Loan officers work in a pretty safe environment

- Loan officers can work for many different companies

- Demand for loan officers is growing

- Loan officers have a rather easy time in the dating market

Loan officers don’t have to work on weekends

One advantage of being a loan officer is that you will have free weekends most of the time and can therefore make many nice trips with your family while bartenders and many other people have to work on Saturdays and even Sundays quite often and will not have this luxury.

You come home from work relatively early

Not only will you have free weekends, but you will also come home from work relatively early as a loan officer.

In fact, most loan officers work in a classical 9 to 5 environment and it can therefore be a great job in case you have a family and want to spend enough time with your kids after work.

Loan officers don’t have to work many extra hours

You also have a rather rigid schedule as a loan officer and don’t have to work many extra hours.

Instead, you will just do your standard shift and will know in the morning when you will come home after work and this can be great since you will have a rather easy time planning your evenings.

Good work-life balance for loan officers

Since loan officers don’t have to work on weekends, holidays and also come home from work relatively early, they have a pretty decent work-life balance and also more than enough time to meet up with their favorite people after work.

Being a loan officer is not very stressful

Another upside to working as a loan officer is that you will also not have to work in the most stressful environment.

While clients can be difficult and you may get into discussions with your coworkers from time to time, you will still have a rather relaxed time at work compared to investment bankers and many other people who have to deal with much higher time pressure.

Most loan officers are not at great risk of burnout

Since you will not have to deal with lots of stress at work, your risk of suffering from burnout or other mental problems will be rather limited as a loan officer and you can spend your workday in a rather relaxed manner most of the time.

Loan officers have enough energy left after work

Since you don’t have to stress your brain at work as much as nurse practitioners or other people who really have to focus heavily on their work to avoid crucial mistakes, you may also have more energy left after work and may be more eager to engage in social activities in the evening.

Loan officers can work indoors

Another benefit of becoming a loan officer is that you can also spend your workday indoors while garbage collectors and many other people who have to work outdoors often have to deal with extremely unpleasant weather conditions.

You don’t have to work in a heavy physical manner

As a loan officer, you also don’t have to work in a heavy physical manner.

Instead, you will do most of your work with your brain and will therefore not have to ruin your body as scaffolders and many other people working in construction often have to do in the long run.

You can help out your loved ones as a loan officer

Another advantage of working as a loan officer is that you can also help out your family and friends in case they need a loan since you can consult them regarding what loan to choose, how long interest rates should be fixed, etc. and by consulting them, they can avoid many crucial mistakes and can get the best loan for the respective situation.

Being a loan officer can be beneficial for your private life

As a loan officer, you will also learn quite a lot for your own life since you will see many mistakes your clients make over time and can learn from those experiences so that you act in a financially reasonable manner and avoid common mistakes in this regard.

Loan officers are important to keep our system running

You also do pretty important work as a loan officer. Imagine a world without loans.

Most people would not be able to finance a home or other important things of daily life and you as a loan officer can therefore make the lives of many people better.

Loan officers work in a pretty safe environment

Another reason to become a loan officer is that you will also work in a pretty safe environment where your risk of suffering from serious accidents at work will be rather low compared to police officers or other people who often have to risk their lives on a daily basis.

Loan officers can work for many different companies

There are also many different types of loans and you can therefore work for many different companies, including banks, mortgage firms, etc.

In turn, you will have many job opportunities and in case you get fired, chances are that you will find a new job relatively soon.

Demand for loan officers is growing

You should also know that an increasing number of people in society need loans to finance their homes or other important things of daily life and loan officers are therefore in high demand right now and this will likely also be true in the near future.

Loan officers have a rather easy time in the dating market

Since loan officers have decent job security and come home from work relatively early while they can make decent money, loan officers are considered good providers and you will therefore have a rather easy time in the dating market to find someone for a long-term relationship.

Now that you know all the reasons for becoming a loan officer, we also have to talk about the drawbacks of a loan officer career in the following so that you can better decide whether you still want to work as a loan officer or rather want to go for a different job instead.

Disadvantages of Working as a Loan Officer

- Loan officers often need a college degree

- You may have to deal with student loan debt

- Loan officers don’t make really good money

- It may take you long to become independent of your parents

- Working as a loan officer is pretty repetitive

- You work in a classical office job

- You may struggle to see the results of your labor

- Rather limited exit options for loan officers

- Loan officers often can’t work remotely

- Clients can be difficult

- You may be liable for mistakes as a loan officer

- You may have to sell stuff you don’t believe in

- Sales pressure can be enormous

- You may get bored with your job in the long run

- You can’t make everyone happy

Loan officers often need a college degree

One problem with being a loan officer is that you will need a college degree most of the time before you are able to work in this field.

Consequently, you would have to spend lots of time and money on college education and you should really make sure your loan officer career is worth it to you before making this huge commitment.

You may have to deal with student loan debt

Since you will have to spend lots of money on tuition and other expenses related to college, it is quite common for loan officers to take on student loan debt which they have to pay back for many years.

Loan officers don’t make really good money

Compared to other jobs where you need a similar degree, loan officers also make pretty poor money.

For instance, with your finance degree, you could also work as a financial analyst and make much more money in the long run and it may therefore not make sense to become a loan officer from a purely financial standpoint.

It may take you long to become independent of your parents

Since you will have to spend many years in college and may also have to pay back significant amounts of student loan debt, it may also take you quite long to become independent of your parents and to really start your own life since you will often be financially constrained for quite a long time.

Working as a loan officer is pretty repetitive

Another downside to working as a loan officer is that many of your tasks will be pretty repetitive and you will therefore not have any room to be creative at work and may just get frustrated with what you are doing in the long run.

You work in a classical office job

You also work in a classical office environment as a loan officer and will have to work with a computer all day long.

While some people like this kind of work, many others don’t get happy with it in the long run and rather want to work with their hands instead of just relying on a computer doing part of their work.

You may struggle to see the results of your labor

Since you will do lots of paperwork, you will also often struggle to see real results of your labor as a loan officer.

In fact, you will not create any physical tangible products and may lose motivation for what you are doing in the long run due to that.

Rather limited exit options for loan officers

Another disadvantage of becoming a loan officer is that exit options are rather limited in this field and you will do the same job for many years or even decades without having a big chance of getting promoted anytime soon.

Loan officers often can’t work remotely

While some loan officers are able to work remotely for some days per week, others have to be present at their workplace in person all the time and working fully remotely is almost impossible since you will also have to meet up with your clients in person in most cases.

Clients can be difficult

While most of your clients will be friendly and appreciate your work, you will also have to deal with some annoying people from time to time and if you don’t know how to handle the pressure that comes along with it in a proper manner, you may not get happy as a loan officer in the long run.

You may be liable for mistakes as a loan officer

If you don’t focus on your work and make mistakes that may lead to a financial loss for the company you work for or for your clients, you may also be liable for mistakes and you should therefore get proper insurance, especially if you work self-employed in this field so that you are covered in case of emergency.

You may have to sell stuff you don’t believe in

As a loan officer, you will often work commission-based and you may therefore sell many products to your clients that pay great commissions but that you may not even believe in from the bottom of your heart and this may lead to serious emotional conflicts in the long run.

Sales pressure can be enormous

Another downside to a loan officer career is that overall sales pressure can be enormous and if you don’t sell enough loan contracts, you may get fired pretty quickly and this can really increase overall pressure at work.

You may get bored with your job in the long run

Since your work will be pretty repetitive, you may just lose motivation for what you are doing and may really get fed up and bored with your loan officer career in the long run.

You can’t make everyone happy

While you will grant many loans, you can’t grant all loan applications and therefore can’t make everyone happy and rejected clients may get really angry with you and may even get into serious disputes with you from time to time.

Top 10 Being a Loan Officer Pros & Cons – Summary List

| Being a Loan Officer Pros | Being a Loan Officer Cons |

|---|---|

| Loan officers don’t have to work many extra hours | Loan officers don’t make really good money |

| Loan officers don’t have to work on weekends | Questionable future outlook for loan officers |

| Decent work-life balance for loan officers | Loan officers often need a degree |

| Loan officers can help out their loved ones | Student loan debt may become a problem |

| You learn a lot for your own life | It may take you long to become independent |

| Loan officers can work indoors | Clients can be difficult |

| Stress at work is rather limited | You have to reject many loan applications |

| You don’t have to work in a physical manner | Sales pressure can be enormous |

| Loan officers don’t have to ruin their bodies | You often work commission-based |

| Loan officers can make many people happy | Your tasks will be pretty repetitive |

Should You Become A Loan Officer?

While becoming a loan officer can make quite a lot of sense since you will have pretty decent work-life balance, solid job security and can make decent money, you should also know that most loan officers don’t get rich and also have to do pretty repetitive tasks while they often also have to deal with many difficult clients.

In the end, it is on you to evaluate all the advantages and disadvantages of being a loan officer so that you can better decide whether you still want to become a loan officer or rather want to work in a different field instead.

If you come to the conclusion that a loan officer career is not for you, you may also want to check out the following articles:

Advantages and disadvantages of being an air traffic controller

Advantages and disadvantages of being a restaurant manager

Advantages and disadvantages of being a barista

Sources

Own research and interviews.

About the author

My name is Andreas and my mission is to educate people about the different career paths that are possible in our current state of the world.

In my opinion, people often make the mistake to choose their profession solely based on how much money they can earn from it instead of doing what makes them really happy.

This is quite sad and I just want to give people a more objective picture of what a fulfilling career could look like.

I did the same when I started working in consulting after finishing my Master’s degree in Economics.

However, I’ve quit pretty soon after that since I haven’t found true meaning in my job.

Now I can do what I really love to do and I want to enable as many other people as well to go on this exciting path towards happiness instead of just money.

I conducted various interviews with employees to give you a good impression of what working in different fields will look like so that you can make the best possible decision regarding your future career choice.

Wanna support my blog? Share it!